Homeowners Insurance in and around Oregon

If walls could talk, Oregon, they would tell you to get State Farm's homeowners insurance.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

Home is where memories are created laughter never ends, and you enjoy coverage from State Farm. It just makes sense.

If walls could talk, Oregon, they would tell you to get State Farm's homeowners insurance.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Open The Door To The Right Homeowners Insurance For You

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your most personal possessions safe. You’ll get a policy that’s modified to fit your specific needs. Luckily you won’t have to figure that out alone. With empathy and terrific customer service, Agent Ryan Gerharz can walk you through every step to build a policy that guards your home and everything you’ve invested in.

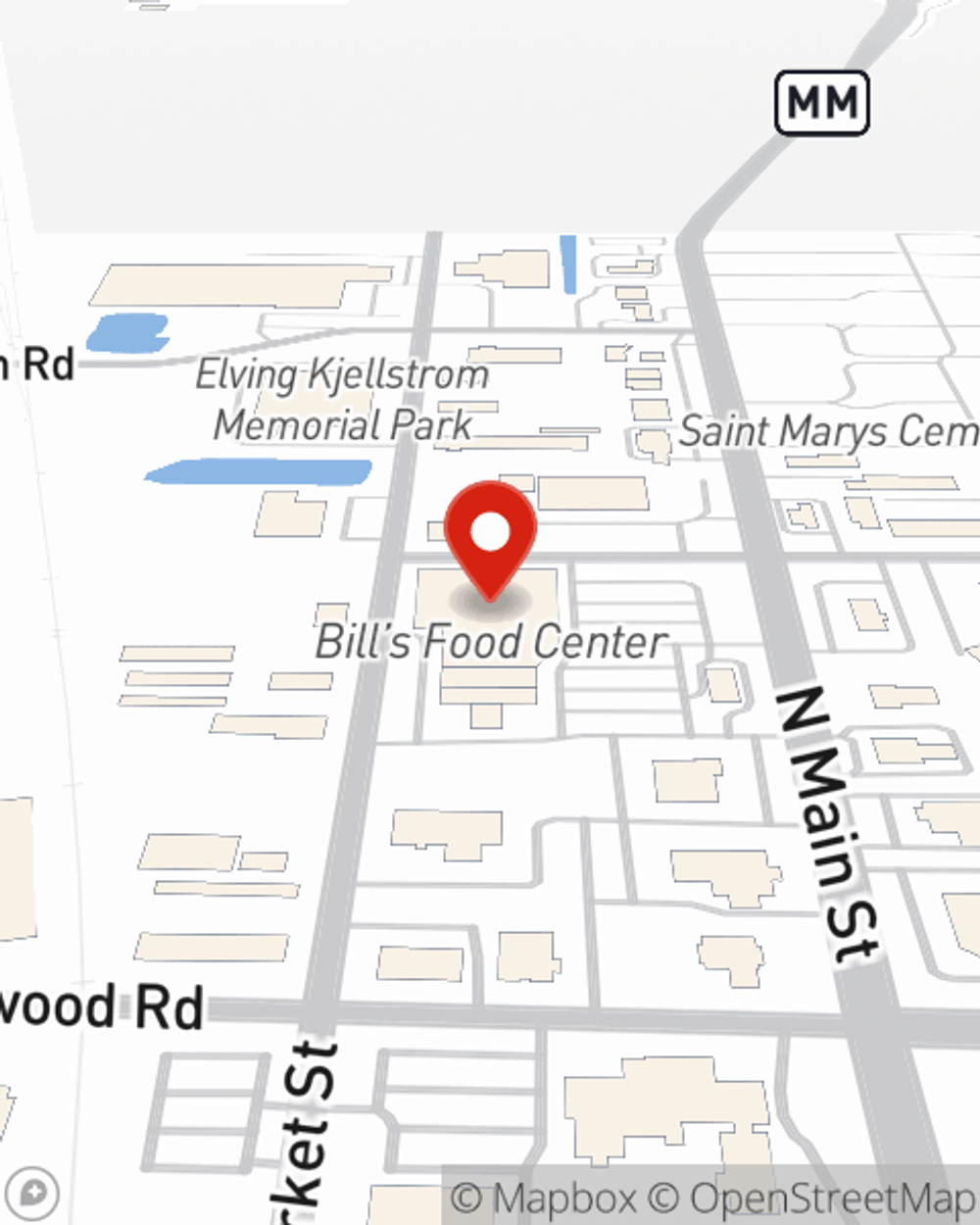

More homeowners choose State Farm® as their home insurance company over any other insurer. Oregon homeowners, are you ready to explore what a State Farm policy can do for you? Contact State Farm Agent Ryan Gerharz today.

Have More Questions About Homeowners Insurance?

Call Ryan at (608) 291-2828 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

11 signs you should think about rewiring your home

11 signs you should think about rewiring your home

Rewiring a house may be a good idea if you notice one or more of these 11 telltale signs from State Farm. Read them now.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Ryan Gerharz

State Farm® Insurance AgentSimple Insights®

11 signs you should think about rewiring your home

11 signs you should think about rewiring your home

Rewiring a house may be a good idea if you notice one or more of these 11 telltale signs from State Farm. Read them now.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.